Top NYC, NY Insurance Companies (113)

Don't see your company?

Create a company profileFlourish provides innovative access to financial products that help advisors secure their clients’ financial futures. We work with over 700 wealth management firms that collectively represent more than $1.5 trillion in assets under management across three products: Flourish Annuities, Flourish Cash, and Flourish Crypto — with additional exciting products in the works. Headquartered in New York City, we are an independent subsidiary of MassMutual Life Insurance Company (MassMutual). Please visit flourish.com for more information. The Flourish business is owned by MassMutual. Flourish Insurance Agency LLC,Flourish Technologies LLC, Flourish Financial LLC, and Flourish Digital Assets LLC are indirect, wholly-owned subsidiaries of MassMutual. Flourish Annuities is offered through Flourish Insurance Agency LLC and Flourish Technologies LLC. Flourish Cash is offered through Flourish Financial LLC. Flourish Crypto is offered through Flourish Digital Assets LLC and Paxos Trust Company, LLC (Paxos). Paxos is not affiliated with any Flourish entity.

Insurance... sounds slow, old-fashioned, and unexciting. Exactly. Insurance is broken, and it's failing fast-moving startups and growing technology companies. Vouch is a new, technology-first insurance company backed with $160M in funding from world-class investors. Like Stripe for payments or Brex for credit cards, Vouch is creating the go-to business insurance for high-growth companies. We're doing this by making insurance fast, responsive, and focused on our customers -high growth and innovative companies. Instead of printed PDF applications and week-long waits, Vouch is building new technology to solve real problems, writing policies that actually cover relevant startup scenarios, and designing simple experiences in an otherwise frustrating industry

Every morning, 10,000 Americans wake up and begin their first day of retirement. Chapter is re-inventing the way that Americans transition into retirement, starting with Medicare. We are re-authoring the retirement narrative by enabling Americans to age with purpose and security and to define their best Chapter. For most people, Medicare is boring, bureaucratic, and confusing. But it's tremendously important. The current Medicare brokerage market is rife with misaligned incentives and path dependence that have pernicious affects on retirees. Our team and technology help retirees to navigate Medicare, including when and how to sign up, what specific plans to choose, and how to maximize the benefits from their coverage. Chapter has built industry-leading technology to help retirees save thousands of dollars on their healthcare. We are the only Medicare advisor (and perhaps the only insurance advisor of any industry) that recommends insurance plans that do not pay us. We build both consumer-facing software that’s highly accessible to our members and internal-facing software that uses our data integration, data modeling, and recommendation engine to give our Medicare advisors super powers.

We’re tackling one of the most impactful ways to improve health in the US: Fixing employee health benefits. Health insurance keeps 157 million US employees healthy – yet it’s too complex, confusing, and costly. We envision a world where access to health benefits is no longer a barrier to health, it is an enabler – the way it’s meant to be.

Our mission is to make the best pet care possible fur all! We aim for Pumpkin to be the premiere brand for new and pro pet parents alike. The people at Pumpkin work under the guiding principle of ‘pets come first’. This means providing every pet with the essential preventive care & pet insurance they need to stay healthy throughout their lives. Just like our beloved fur members, everyday at Pumpkin we share toys, jump fences and dig new holes; Bark at us if this sounds like a treat!

You’ll Like It Here At Northwestern Mutual, we believe that our lives and our work matter. And that doing what’s right is good for everyone. We follow through by designing tech that improves the community and cultivating creative ways to make finance accessible anywhere. These guiding principles have allowed our company to grow for more than 160 years. Here, you’ll be with a team who emphasizes integrity and prioritizes security to design experiences that better everyone. You’ll work in cross functional teams to create optimal solutions that are rooted in innovative strategy and thoughtful execution. And you’re provided development tools and opportunities to become a leader all with the support of a collaborative team. You’ll be surrounded in a culture that values innovation and works to always evolve to stay ahead of trends and client needs. We are intentional in seeking out team members who will challenge us. Our employees choose us for the career opportunities, commitment to philanthropy and desire to have a meaningful impact in the lives of our clients. You have career passions and goals. We have ambition and opportunity for you to grow your future in tech. Discover today: https://careers.northwesternmutual.com/

Named one of Fortune’s “World’s Most Admired Companies,” MetLife is leading the global transformation of an industry we’ve defined for more than 150 years. At MetLife, every innovation and line of code is a lifeline for our customers and their families—from victims of natural disasters to people living with disabilities and beyond. With operations in more than 40 markets and leading positions across the globe, MetLife’s building a workforce of diverse and empowered voices that all belong. Join our remarkable journey—one in which you help write the next century of innovation in financial services—because with MetLife, making the world a better place is All Together Possible.

IEX (IEX Group, Inc.) is dedicated to providing access and improving performance across industries, via our portfolio of Exchange, Digital Assets and Technology businesses. Founded in 2012, IEX launched a new kind of securities exchange in 2016 that combines a transparent business model with innovative design to better protect investors and level the playing field. Today, we’re applying our experience and proprietary technology to remove barriers, unlock scale, and help people seize new opportunities for growth in a variety of industries.

Since 1851, MassMutual’s commitment has always been to help people protect their families, support their communities, and help one another. This is why we want to inspire people to Live Mutual. We’re people helping people. Together, we’re stronger.

Route gives consumers the power to track all their orders in one place from any merchant. With a Route integration, a consumer is able to carbon neutralize their package with green tracking and green package protection. If any issues arise, users can resolve an order issues within a few taps with resolve. Additionally, Route partners with merchants to turn tracking into a brand-building opportunity, providing a full suite of ecommerce tools that easily integrates into their site, and allows merchants to optimize how their brand is discovered by shoppers worldwide. Learn more at www.route.com

SageSure is an innovation-focused insurance and technology company specializing in underserved property markets. As the leading homeowners insurtech organization in the U.S. measured by premium and profitability, we offer more than 40 competitively priced insurance products on behalf of our carrier partners, serving 300,000+ policyholders. SageSure partners with a growing network of insurance agents and brokers in 14 coastal states.

Milliman is among the world’s largest independent actuarial and consulting firms. Founded in Seattle in 1947, Milliman has offices in key locations worldwide. Through consulting practices in employee benefits, healthcare, investment, life insurance and financial services, and property & casualty/general insurance, Milliman serves the full spectrum of business, financial, government, union, education, and nonprofit organizations. In addition to consulting actuaries, Milliman’s body of professionals includes numerous other specialists, ranging from clinicians to economists.

Modern Life is a tech-enabled insurance brokerage helping everyone protect what matters most. Our platform empowers today’s advisors with advanced technology and expert support to help them serve their clients faster, more easily, and more confidently.

Alaffia Health is a healthtech company that uses machine learning and AI to identify and eliminate provider fraud, waste, and abuse in healthcare claims. We work with health plans, TPAs, self-funded employers, reinsurers, and government agencies to lower healthcare costs by eliminating overpayments. Visit our website to learn more!

Assured Guaranty is the leading provider of financial guaranty insurance. We guarantee timely payment of scheduled principal and interest when due on municipal, public infrastructure and structured financings. Issuers use our financial guarantees to lower their cost of funds, broaden distribution and diversify funding sources. For more than three decades, our insurance subsidiaries have helped to lower the cost of borrowing for municipalities and other issuers across the United States by guaranteeing a wide range of tax-exempt and taxable, investment-grade, municipal bonds that are supported by either tax revenues or revenues from essential public projects or services. From schools to clean water, from transportation projects to hospitals and more, we help municipalities build sustainable public infrastructure and better serve their residents, including their underserved and at-risk communities. We are also active in the United Kingdom, Europe, Australia and other developed countries, where we guarantee public-private partnership, local authority and regulated utility financings. In structured finance, globally, we guarantee asset securitizations and craft custom applications of our guarantees to assist our institutional clients in managing their portfolio risk and capital. For investors, our value proposition includes not only the security of our unconditional, irrevocable guaranty but also our experienced credit selection, underwriting and surveillance. Our business model has proven its resilience through multiple business cycles, and we have demonstrated our commitment to maintaining the financial strength to protect our policyholders for the life of their insured investments. In addition, our subsidiary Assured Investment Management LLC provides alternative investment management and advisory services to institutional and other qualified investors through our investment arm and offers a variety of credit-focused strategies and structured finance solutions.

At Nayya, we believe there is a better way to choose and use benefits. A more transparent, less confusing way where consumers feel more confident in their decisions. We focus on decision support and benefits engagement. It’s one of the most stressful and challenging situations consumers face – and we see that as an opportunity to do good. We’re excited to deliver a new experience to consumers, where they choose and use their benefits through our software, data and AI engine.

More than 7,500 professionals provide 52,000 clients globally with creative solutions in risk management, insurance and employee benefits consulting. Our entrepreneurial Associates are committed to service and empowered with a single-minded focus on delivering results for clients. From its 1966 founding in Kansas City, Missouri, Lockton has grown to become the largest privately held insurance broker in the world and 8th largest overall. We’re purposefully unconventional, insatiably curious and Uncommonly Independent.

Designed specifically for specialty insurance programs, PolicyFly is a complete policy management platform that brings agents, brokers and customers into one experience. We help insurers build better, more-profitable programs with streamlined online applications, faster and smarter underwriting and the best technology money can buy.

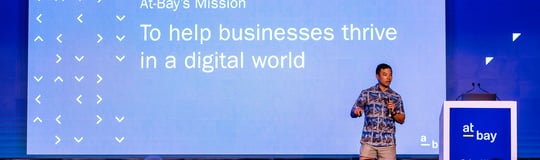

We address digital risk in a way that everyone, from brokers and business owners to CISOs and CFOs, can all understand. We question, analyze, and monitor the risk of every company in our portfolio — not just once, but continuously — so we can educate, advise, and support our brokers and our insureds throughout our partnership. Because digital risk never rests, and neither do we. To learn more about At-Bay, visit www.at-bay.com. LinkedIn: https://www.linkedin.com/company/at-bay/mycompany/ Instagram: https://www.instagram.com/keeprisk_atbay/

Argo Group is a U.S.-focused underwriter of specialty insurance products in the property and casualty market. We offer a full line of products and services designed to meet the unique coverage and claims-handling needs of businesses. Since 1957, we share a firm commitment to working together with independent agents, wholesale brokers and retail brokerage partners to deliver innovative products for niche markets. Headquartered in Bermuda, we’re a diverse company with multiple offices in the United States, United Kingdom, Brazil and United Arab Emirates. Our belief that the company’s success is linked to our employees drives our commitment to creating an environment and culture of respect where everyone can thrive. We value helping the communities around us, growing alongside our employees through innovation and creating a workplace with work-life balance.

Work Your Passion. Live Your Purpose.

.jpeg)

.jpg)

.png)

.jpeg)

.jpg)

.png)